Trusts are powerful tools in estate planning, offering numerous benefits such as asset protection, tax efficiency, and privacy. Understanding the different types of trusts and their specific applications enables individuals to make informed decisions about their estate planning strategies. Let’s take a look at the most common types of trusts and how they might benefit your estate plan.

{{blog-cta-legal}}

Testamentary Trusts

A testamentary trust comes into effect upon the trust creator's death, also known as the grantor or settlor. This trust is established through a will and does not exist during the grantor's lifetime.

Key Features of Testamentary Trust

- Creation Through a Will: The trust is detailed within the grantor's last will and testament, specifying the trust's terms, beneficiaries, and trustee.

- Activation Upon Death: The trust only becomes operational after the grantor's death, when the will goes through probate.

- Subject to Probate: As part of the will, the trust must go through the probate process, which can be time-consuming and public.

- Flexibility in Terms and Conditions: The grantor can set specific conditions for asset distribution, such as age requirements or educational milestones for beneficiaries.

- Separate Tax Entity: Once active, the trust becomes a separate entity requiring its own tax ID and annual tax returns.

- Court Supervision: The trust may be subject to ongoing court supervision to ensure proper administration.

- Potential for Contestation: Like other aspects of a will, dissatisfied heirs can contest testamentary trusts.

When to Use Testamentary Trusts:

- Providing for Minor Children: Parents can create testamentary trusts to manage assets for their children until they reach a specified age.

- Special Needs Planning: These trusts help provide for special-needs beneficiaries without jeopardizing their eligibility for government benefits.

- Estate Tax Planning: Testamentary trusts can help minimize estate taxes for larger estates.

- Asset Protection: They offer protection against creditors and potential lawsuits for beneficiaries.

- Controlling Asset Distribution: Grantors can specify how and when beneficiaries receive assets, potentially over an extended period.

Revocable Living Trusts

A revocable living trust, often called a living trust, is created during the grantor's lifetime and can be altered or revoked before death.

Key Features of Revocable Living Trusts

- Created and active during the grantor's lifetime: The trust is established and funded while the grantor is alive, allowing immediate asset management.

- Amendable and revocable: The grantor can modify, add to, or entirely revoke the trust at any time, providing maximum flexibility.

- Avoids probate: Assets properly transferred to the trust bypass the probate process, saving time and maintaining privacy.

- Grantor maintains control of assets: Typically, the grantor serves as the initial trustee, retaining complete control over trust assets.

- Seamless transition upon incapacity: A successor trustee can take over management if the grantor becomes incapacitated without court intervention.

- No separate tax entity during the grantor's life: The trust uses the grantor's Social Security number and income reports on the grantor's tax return.

- Privacy preservation: Unlike wills, revocable trusts are not public records, maintaining family privacy.

- Potential for multiple grantors: Married couples can create joint revocable trusts, managing their combined assets.

When to Use Revocable Living Trusts:

- Probate Avoidance: Assets in a revocable trust bypass the probate process, saving time and money.

- Privacy Preservation: Unlike wills, revocable trusts are not public records, maintaining family privacy.

- Incapacity Planning: These trusts provide for the management of assets if the grantor becomes incapacitated.

- Flexibility: Grantors can make changes as their circumstances or wishes evolve.

- Smooth Asset Transfer: Revocable trusts facilitate a smoother, quicker transfer of assets to beneficiaries.

Irrevocable Trusts

An irrevocable trust, once created, cannot be altered, amended, or revoked without the beneficiary's permission. The grantor effectively gives up control of the assets placed in the trust.

Key Features of Irrevocable Trusts

- Cannot be changed without beneficiary approval: Once established, the terms of the trust are typically permanent, providing long-term stability and asset protection.

- Assets removed from grantor's estate: Property transferred to the trust is no longer considered part of the grantor's estate, potentially reducing estate taxes.

- Separate tax entity: The trust has its own tax ID and files its own tax returns, often with more favorable tax treatment than individual rates.

- Asset protection: Assets in the trust are generally protected from the grantor's and beneficiaries' creditors.

- Potential tax benefits: Depending on the structure, irrevocable trusts can offer income tax, gift tax, and estate tax advantages.

- Medicaid planning tool: Properly structured irrevocable trusts can help protect assets while qualifying for Medicaid benefits.

- Specific purpose trusts: Many specialized irrevocable trusts exist for particular purposes, such as charitable giving or life insurance management.

- Professional management: Often managed by professional trustees, ensuring proper administration and investment management.

When to Use Irrevocable Trusts:

- Estate Tax Reduction: By removing assets from the grantor's estate, irrevocable trusts can significantly reduce estate taxes.

- Asset Protection: These trusts shield assets from creditors and legal judgments.

- Medicaid Planning: Irrevocable trusts can help individuals qualify for Medicaid by reducing countable assets.

- Charitable Giving: Certain irrevocable trusts, like Charitable Remainder Trusts, facilitate philanthropic goals while providing tax benefits.

- Life Insurance Planning: Irrevocable Life Insurance Trusts (ILITs) remove life insurance proceeds from the taxable estate.

Specialized Trust Types

Beyond the main categories, several specialized trusts cater to specific needs:

Special Needs Trusts

These trusts provide for individuals with disabilities without jeopardizing their eligibility for government benefits.

Spendthrift Trusts

These trusts limit a beneficiary's access to assets. Funds are released incrementally, protecting the inheritance from creditors and potential financial mismanagement.

Charitable Trusts

These include Charitable Remainder Trusts and Charitable Lead Trusts, balancing philanthropic goals with tax benefits.

Generation-Skipping Trusts

These trusts transfer wealth to grandchildren or later generations while minimizing generation-skipping transfer taxes.

Qualified Terminable Interest Property (QTIP) Trusts

Provide income to a surviving spouse while maintaining control over the final disposition of assets.

Factors to Consider When Choosing a Trust

Selecting the appropriate trust type depends on various factors:

- Estate Size: Larger estates may benefit more from complex trust structures for tax planning.

- Family Dynamics: Consider the needs and capabilities of potential beneficiaries.

- Asset Types: Different assets may require specialized trust structures.

- Control Desires: Determine how much control the grantor wishes to retain over assets.

- Tax Implications: Evaluate the potential income, estate, and gift tax consequences of different trust types.

- Long-term Goals: Consider long-term financial and personal objectives when structuring trusts.

- State Laws: Trust laws vary by state, potentially affecting the choice and structure of trusts.

{{blog-cta-legal}}

Conclusion

Trusts offer powerful tools for estate planning, asset protection, and tax management. The choice between testamentary, revocable, and irrevocable trusts, as well as specialized trust types, depends on individual circumstances, goals, and needs.

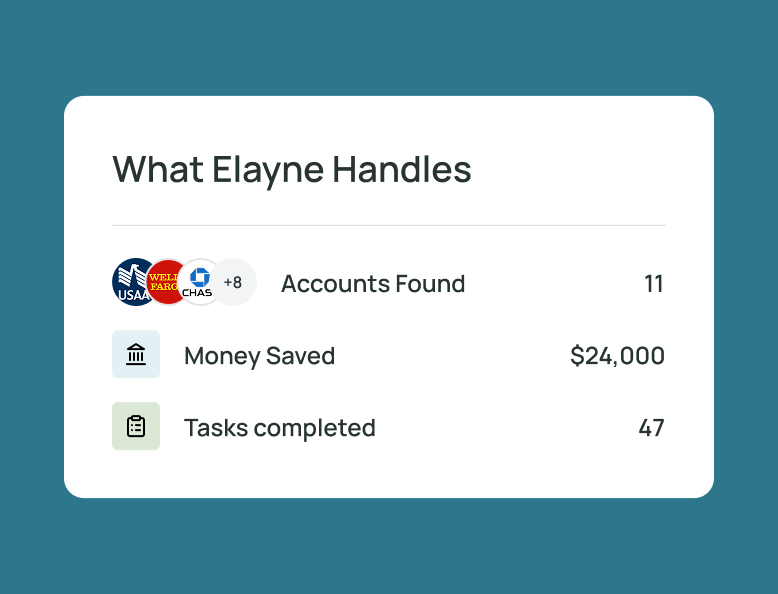

Given the complexity of trust law and the significant impact these decisions can have on the financial and family legacy, individuals should consult with experienced estate planning attorneys and financial advisors before deciding. These professionals can offer customized advice, ensuring the trust structure aligns with personal goals, family needs, and legal requirements.

By carefully considering the various trust options available, individuals can create a comprehensive estate plan that secures their legacy and provides for their loved ones effectively.

.jpg)